Tip Jar

A product to help bartenders verify their tip-based income

Problem

Bartenders, and other tip-based income workers, find it difficult to get financing and loan approval due to their income type: cash tips, credit card slips, paychecks etc..

Solution

An easy-to-use platform to track daily earnings, organize & verify income data, and create detailed reports that can be presented to financial lenders as credible proof-of-income.

I have worked as a bartender for over 6 years, and at every employer I have had to find unique ways to keep track of my tips and income.

Recently, I was looking to purchase a new vehicle, but I realized that my tip-based income made it difficult for lenders to approve me for loans.

My thought process brought me to this project, where I explore the unique challenges of service-industry workers and come up with a one-of-a-kind product to help them verify their tip-based income

I wonder if other bartenders are facing similar challenges?

Investigating the Problem Space

Reflecting on my own experience, I was unable to secure an auto loan because lenders mentioned I did not have reliable proof-of-income due to my employment style. As a bartender, essentially all income is generated through tips.

I spoke with 6 of my coworkers in an informal group interview, and discussed their experiences around recording their income and applying for loans.

Bartenders Faced Challenges

Tracking their tips

Keeping records of their income

Applying for loans (auto loan, home loan, etc…)

How do you keep track of the money you make each day?

“I use this app Tipsy to record my tips”

“I just use my iphone notes to record what i make each shift”

“each year I try to keep track, but i always just give up honestly”

“i add up what i made each day in my calculator and screenshot it”

“i have a shoebox with a piece of paper taped to the top, where i write down how much money I put in”

It was pretty enlightening to see the different methods people were using to record their tips. Some individuals used a journal, a piece of a paper tapped to a shoebox, iPhone notes, finance apps, or simply gave up keeping track at all.

The most important insight, however, was regardless of how they were recording their tips, it didn’t actually matter when they applied for loans. Not surprising, but lenders don’t see a list of shift tips on iPhone notes as exactly credible or verifiable.

How can we make the fact that someone has taken the time to track their tips matter to financial lenders?

understanding the nuances of the income tracking

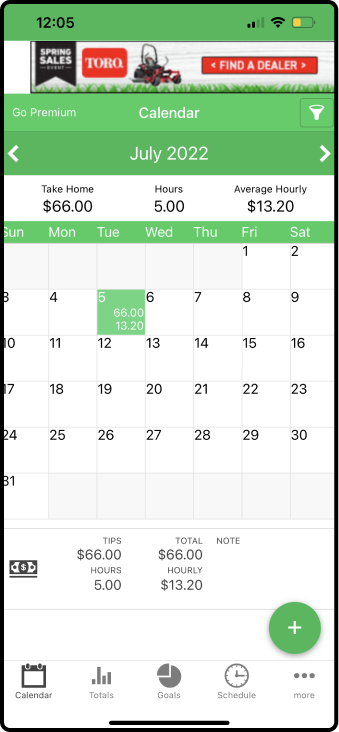

Some bartenders mentioned they used specific apps to track their tips. I went ahead and researched and downloaded the top three tip-tracking mobile products on the market.

If there are already products on the market aimed at tip-tracking, why are so many bartenders still dealing with the same challenges?

The short answer… these products are just a glorified Excel sheet.

Why are these methods unsuccessful in helping bartenders get financing?

None of the products on the market address the issue of income verification.

These products never make the connection between tracking one’s tips and then being able to verify that income. Without verifying income to a potential lender, saying you make money has no impact in the lending process if the lender doesn’t believe you. Therefore, the current applications on the market are no more effective than using iphone notes or a journal.

Competitors

Strengths

Enter tips directly on homepage

Calendar view

Date picker

Income statistics

Weaknesses

No tip verification system

Outdated UI design

Information overload

Lack of visual hierarchy

Third-party ads

It is not enough to make a product that only helps bartenders track their tips, they need a way to verify their income.

Framing the Problem

For a product to help bartenders it needs to be able to accomplish three tasks:

Record tips

Verify self-reported income

Present income report to financial lenders

Why does it need to address these three areas?

A product that only acts as a tip-tracking tool does not provide the income verification lenders need to determine credible proof-of-income.

How Might We:

Help Bartenders record and verify their tip-based income?

Help Bartenders Get approved for loans?

Having an inherent income verification system is the distinguishing aspect of our product. I called the solution, Tip Jar.

Building A solution

Even at lo-fidelity, Tip Jar, needed to feel credible and professional, since it would be creating income reports that financial lenders would need to use and deem legitimate. The current tip-tracking applications on the market were extremely lacking in professionalism, suffered from overcrowded elements, and had poor visual hierarchy.

The difficulty at this stage was figuring out the best way to implement a verification system into Tip Jar’s product flow. I had to come up with a novel way of legitimizing tips that had been reported. To achieve this, I thought back to working in a bar myself, and at the end of a shift many times a manager would have to “sign-off” on your shift report, or close out the bar’s POS system. I thought if we could implement a system that included manager accounts, users could enter their tips and then a manager could verify them.

Through usability testing I was able to develop multiple iterations of Tip Jar and refine the user flow and verification system before heading into a higher fidelity design stage.

Design Themes

Enter tips directly on homepage

See recently entered tips

Ability to have multiple employers

many industry workers have multiple jobs

Visually identify verified tips

Simple navigation bar

Distinct content sections

Shareable income report

Income statistics

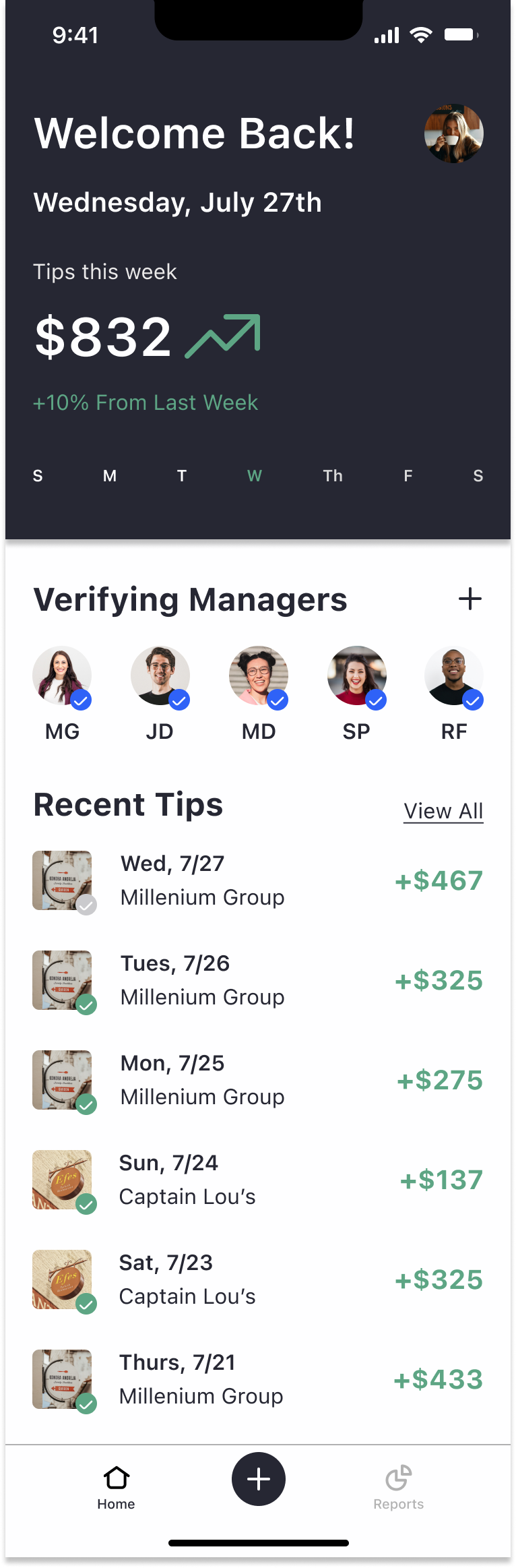

Homepage Iterations

Initially, I had created a verification system where a user submitted their tips, then those tips were verified with a blue checkmark. However, after usability testing users failed to grasp that concept in the way I had hoped. When I implemented manager profiles, who verify submitted tips, users were quick to understand the format as it was very similar to how restaurants operate, where managers sign-off on end-of-shift reports.

Manager profiles would be blue check verified, like Twitter, and transparent so lenders could see who was verifying the income, recognize their credibility, and contact if necessary.

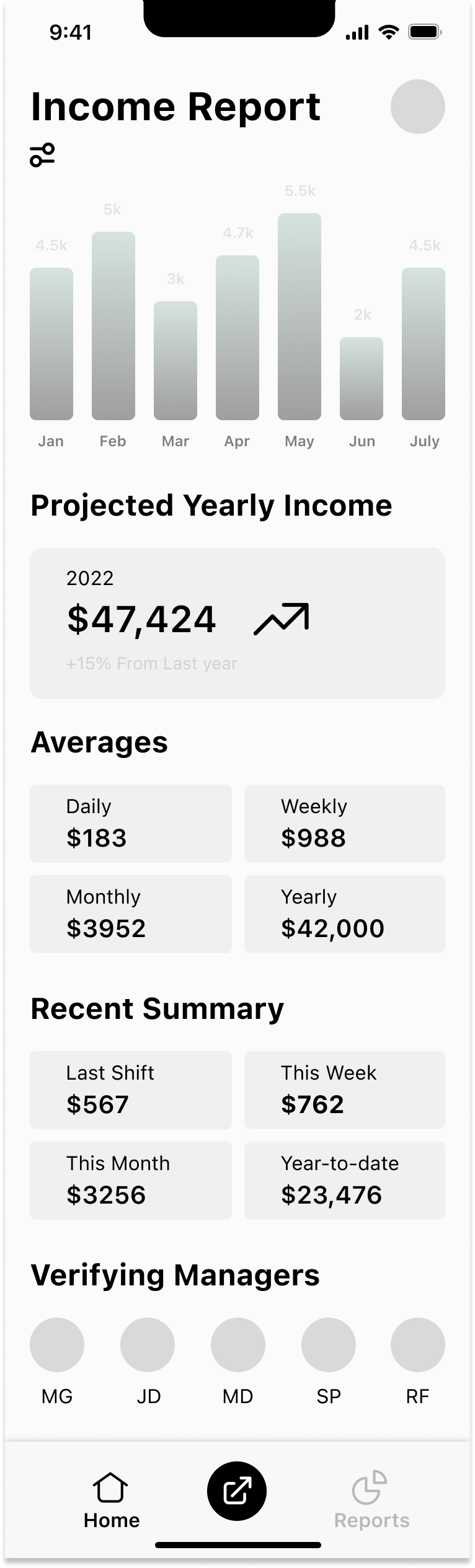

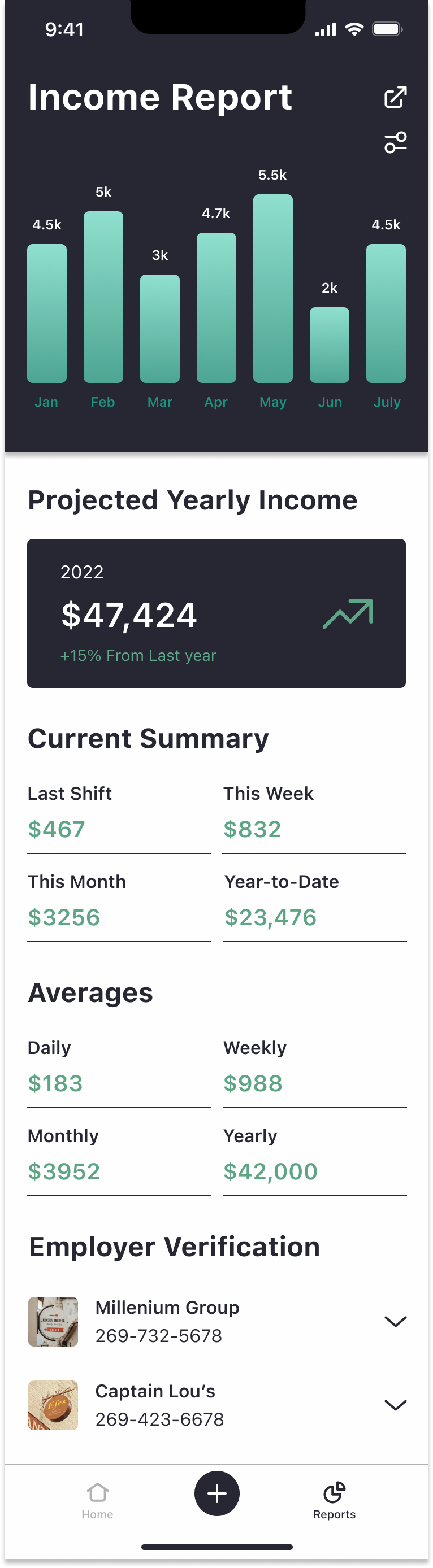

Income Report Iterations

In order for users to be able to prove to lenders that they have documented income, I designed an Income Report page, where bartender’s could see their income statistics, averages, managers, and financial projections.

By having a report page, users would be able to have all of their income records in one place and create a shareable PDF they could use during loan applications.

Increasing Fidelity

In order to instill a sense of trust and professionalism with users and financial lenders, I upscaled Tip Jar using blue (primary) and green (secondary) as the brand colors. The combination of blue, green, and white reflects the trends in the fintech industry most commonly seen in banking and investment products.

I implemented a push notification functionality to remind users to enter their tips, as mentioned in user interviews bartenders commonly forget to record their tips due to being tired, stressed, or overworked at the end of the night.

Creating a new way to record tips

When users open the app they are greeted with a weekly income tracker that shows proportionally how much they’ve made compared to last week. This function helps user keep their financial goals in perspective, while also serving as an incentive to be diligent about entering their tips so their income metrics are accurate.

Below the header is a content block dedicated to the verified managers that a user has added to their account. When tips are submitted from a user, the corresponding manager will be notified and able to verify or not verify the self-reported amount.

The last content block shows recently entered tips with the corresponding employer. Many industry workers have multiple jobs so it was imperative to include the functionality able to integrate income from multiple sources. A green checkmark will appear once a tip has been verified.

The button on the navigation bar functions as the primary action, where users are able to input more tips and submit them for verification.

Establishing Credibility

Once a user’s tips have been verified, they are integrated into their income report. The report serves a few functions, the two primary being:

Provide helpful income metrics for user benefit

Establish clear proof-of-income for financial lenders

Users are able to see income averages, generate income charts, understand financial projections, and provide a detailed report to financial lenders. The user’s employers are included in the report to serve as references for lenders to contact if necessary.

The entire functionality of Tip Jar is to create a system where bartenders can easily record their tips and simultaneously have their income validated. Tip Jar is an attempt at making the financial lives of bartenders easier and more efficient. By using Tip Jar, bartenders would more easily be able to achieve financial goals and have a higher likelihood of being approved for traditional loans.

Sharing income records

When applying for a loan, lenders require income records and tax documents to determine if a person has sufficient proof-of-income. Bartenders need to be able to share their income records with financial lenders, banks, and other institutions to make use of their income reporting. Tip Jar already establishes a system for workers to keep track of their income, but unsurprisingly, having all this information only stored inside a mobile application doesn’t do much to help lenders.

By designing with iOS in mind, Tip Jar is able to utilize native iOS sharing capabilities to create an effortless experience for users like Jess. By using the iOS design system here, users are able to easily share a PDF of their income report in a variety of formats.

Final Solution

After multiple rounds of usability testing, Tip Jar reached an MVP stage. Utilizing Figma, I developed a prototype showcasing the main user flow of the product:

Entering and recording tips

Generating and sharing an income report

Give the prototype a try below and let me know what you think!